All Startups Are Bullsh*t

So What’s the Difference Between Going Public…and Going to Jail?

On January 12, JPMorgan chase announced that it was shutting down a college financial aid startup named Frank they had purchased for $175m a little over a year earlier. The banking giant alleges that Frank’s founder Charlie Javice had invented millions of fake customer accounts to make the company look more successful. What tipped them off? When the bank emailed 400k Frank customers, and 70% of them bounced back. Whoops.

It seems that Charlie is just the latest in a long line of founders to get tripped up somewhere between healthy startup evangelism and taking “fake it ‘til you make it” a bit too literally. Elizabeth Holmes and Theranos. Carlos Watson and Ozy. Manish Lachwani and HeadSpin.

I was going to title this article “the fine line between vision and delusion,” but I’m not sure there is one. What’s the difference between Theranos back in its early days and any other blood diagnostics startup just getting started now? At founding, the entrepreneur has big plans, but the track record is limited or non-existent.

Are these just the bad eggs? Or is the entire Silicon Valley’s ethos rotten? I’m here to argue that the problem is storytelling gone bad. Startups begin with a pitch. Pitches are, by definition, not true today (otherwise we’d call them “descriptions”). In other words, pitches are bullsh*t, and you can’t place them on a truth-falsehood axis. A successful entrepreneur is someone who then turns BS into reality. For a failed entrepreneur, the BS remains BS.

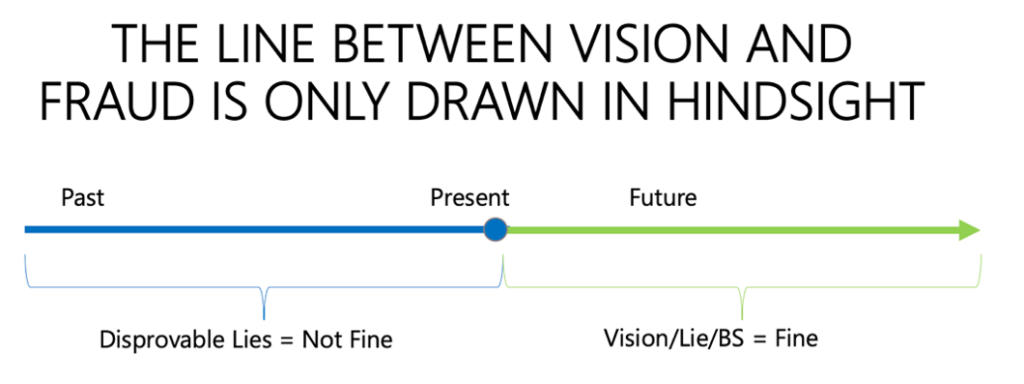

Here’s the key distinction: Lying about the future is vision. Lying about the past is fraud. It looks like this:

Entrepreneurs can’t just be “honest” and skip the forward-looking pitch. They need to tell a compelling story that helps bend the arc of history towards their vision. Stories are what inspire external audiences to link arms and co-create a company’s success. Investors need to write checks. Customers have to buy. Employees must decide to join. So the forward-looking fiction of a great pitch is not just vital, it’s arguably the single most powerful weapon in the entrepreneur’s arsenal.

Where leaders get into trouble is when the reality doesn’t catch up quickly enough to the pitch they’ve been making, so they tell a small lie to buy themselves some time. Then bigger and bigger ones. Suddenly, it just seems too scary to tell the truth. Even Bernie Madoff likely didn’t start out to build a Ponzi scheme. It crept up on him as he discovered that reality had failed to live up to his pitch.

If you insist on the true-false dichotomy, evaluating an entrepreneur’s forward-looking statements can be maddening. Elon Musk has been predicting fully autonomous vehicles for close to a decade. We may not be closer to self-driving cars than we were in 2014, when he predicted it within a year.

Does that make Musk a liar, or a failed entrepreneur? This is a trick question. The answer is indeterminate.

It reminds me of the famous physics thought experiment known as Schrödinger’s Cat, which illustrates a weird aspect of quantum mechanics. Imagine a cat in a closed box. Until you open the box, you can’t be sure whether the cat is alive or dead. In fact, for quantum physics properties beyond the scope of this article, the cat in the experiment is both alive and dead until you open the box. It’s the same thing with a startup story. You only get to open the box when the money runs out. As long as Elon’s career at Tesla continues, his predictions about self-driving cars are essentially true and false at the same time. If someone had invested another $100m into Theranos, it’s conceivable that Elizabeth Holmes would have had time to figure out her tech and we’d all think she was a genius.

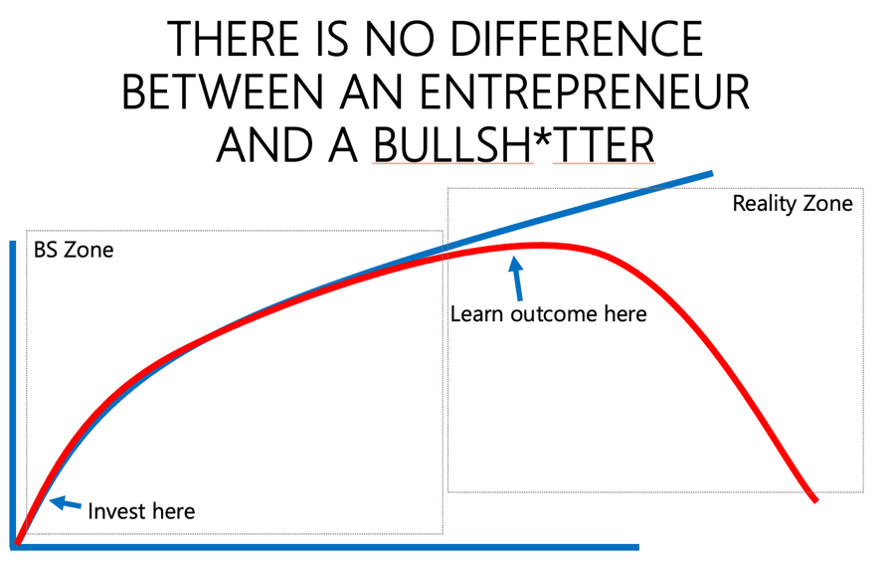

So an entrepreneur has to tell the most compelling story possible, while an investor has to predict whether the entrepreneur is a genius or a liar before it is clear. It looks like this:

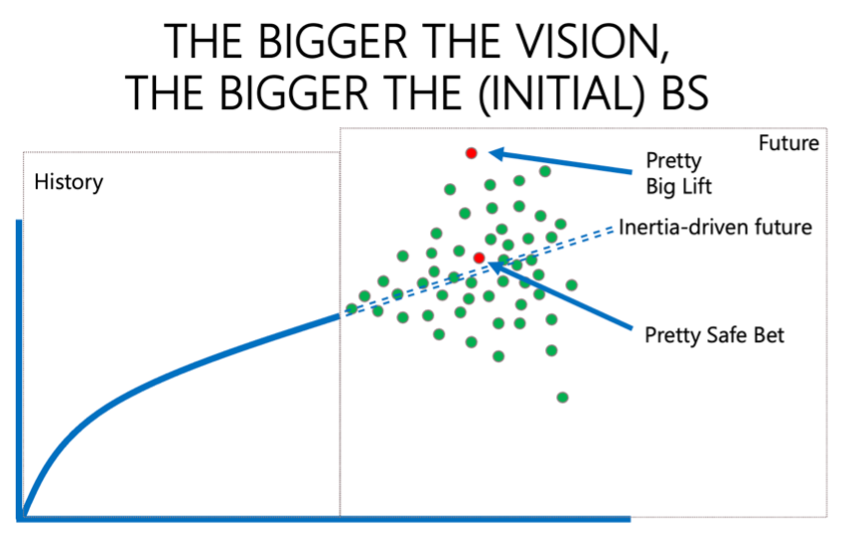

Making it even more challenging is that the crazier the pitch—the more it breaks with the inertia of the past—the more potentially lucrative it is. Certainly Elon Musk fit the bill in 2010 when he said that he was going to build a car company that was going to force the entire car industry to go electric. Forget the transition from gasoline—there had not been any successful new car company in the USA in over half a century. I think of it like this:

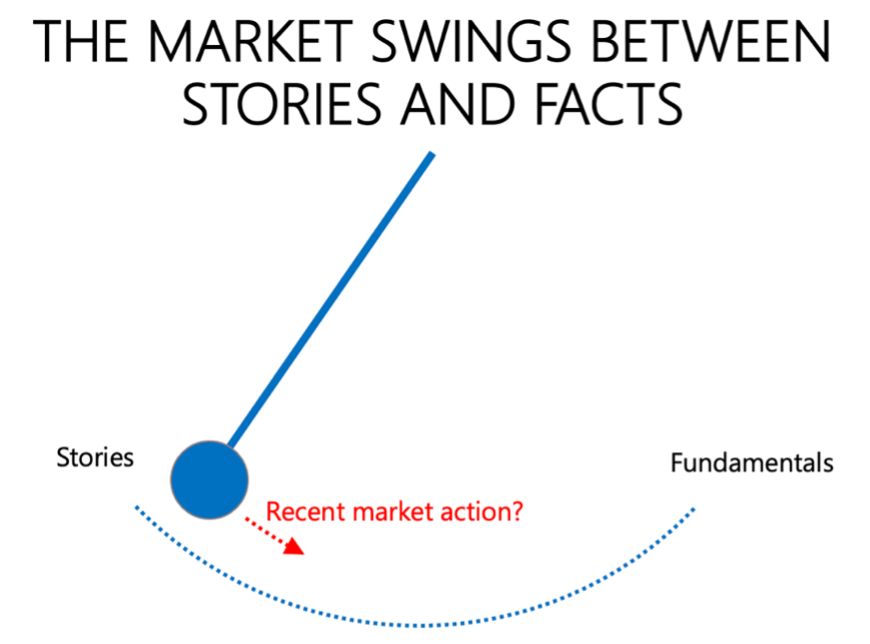

Of course, it’s not just startups that tell stories about the future. Public stock markets are full of companies whose values depend on stories. These are known as ‘growth stocks’ and they are simply stocks that are overvalued based on their ‘fundamentals,’ ie what they’ve done to date. Startups are extreme cases of growth stocks—they’ve done nothing and can be worth many millions. In the stock market the pendulum between growth stocks and value stocks never stands still. In some markets, like we had until recently, there are growth stock darlings that seem to defy gravity. Now it’s swinging back towards value stocks as the mood turns glum. The skepticism with which private investors greet a startup pitch swings back and forth in the same way.

Quality Startup BS

There are two sides to the story game: Entrepreneurs try to weave the most convincing stories, while investors have to place bets on which will come true. Entry-level aggrandizing doesn’t get you far. “We are a leading…” or “We are revolutionizing…” are transparent puffery. It wouldn’t get someone like Elizabeth Holmes very far, and it doesn’t take a Sherlock Holmes to see right through it.

Here are 5 Power Tools of great startup storytelling:

Find the Why. People don’t want to be customers. They want to be disciples. Apple doesn’t sell its phone by talking about features, they talk about how they allow you to unleash your inner artist. Sell outcomes and benefits, not features.

Sell Up the Pohl Pyramid. Taking care of immediate, quotidian needs of your customer is good. Thinking big and framing your product or service in terms of the highest-level benefit to your customer and society is great.

Consistency and Repetition. Every external touchpoint, including pitch deck, website, sales decks, and social media should be singing from the same song sheet. Consistency of story, tone, and visuals sends a strong and memorable message.

Clarity. Replace vague phrases with clear benefits. Pay yourself $100 for each word you can eliminate from a headline or summary.

Sharpen your Call to Action. Every external message should inspire the reader to DO something, whether it’s purchase, invest, or just sign up for your pre-launch newsletter. Lead the horse to water with clear prose and address any reasons they may have not to drink. I’m surprised how many company websites don’t have clear calls to action. To paraphrase Wayne Gretzky, 100% of the horses not led to water don’t drink.

It’s easy to rush to judgment about Elizabeth Holmes or Adam Neumann at WeWork. In both cases, there was an extraordinary gap between the ability of the founders to weave a story for investors and their ability to build a company that matched the hype. But far from illustrating that startup BS is a condemnable lie, these examples show the power of story. Yes, you must build a company that matches your BS. But BS comes first. Make it good and the world will rush to help prove you right.